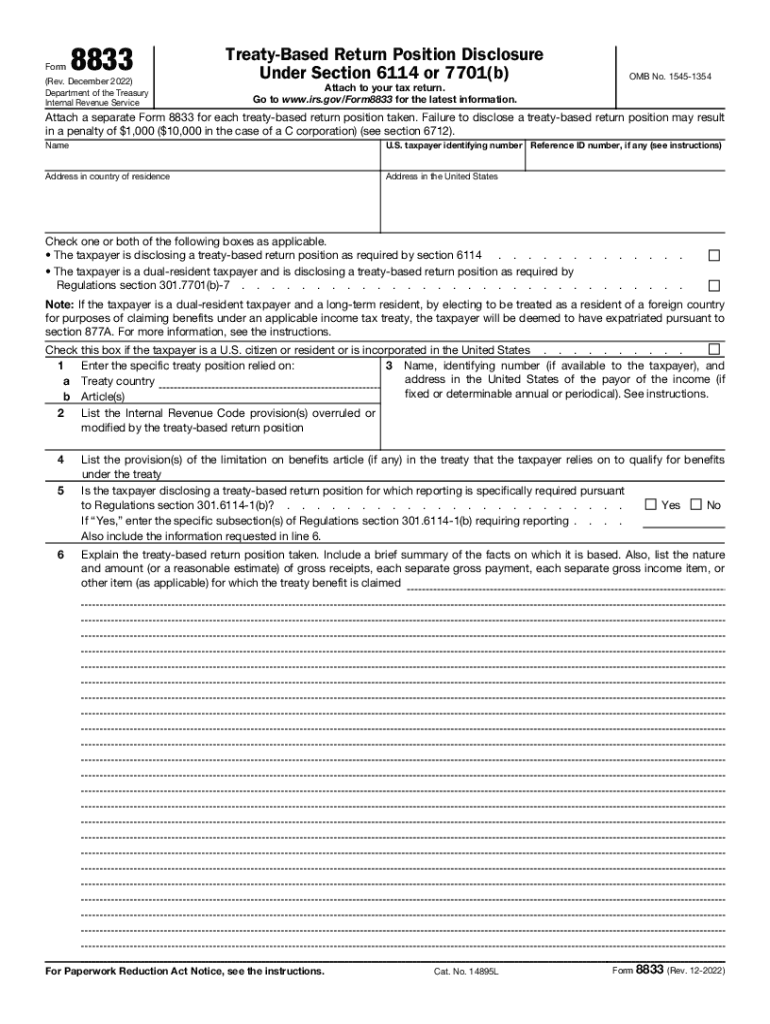

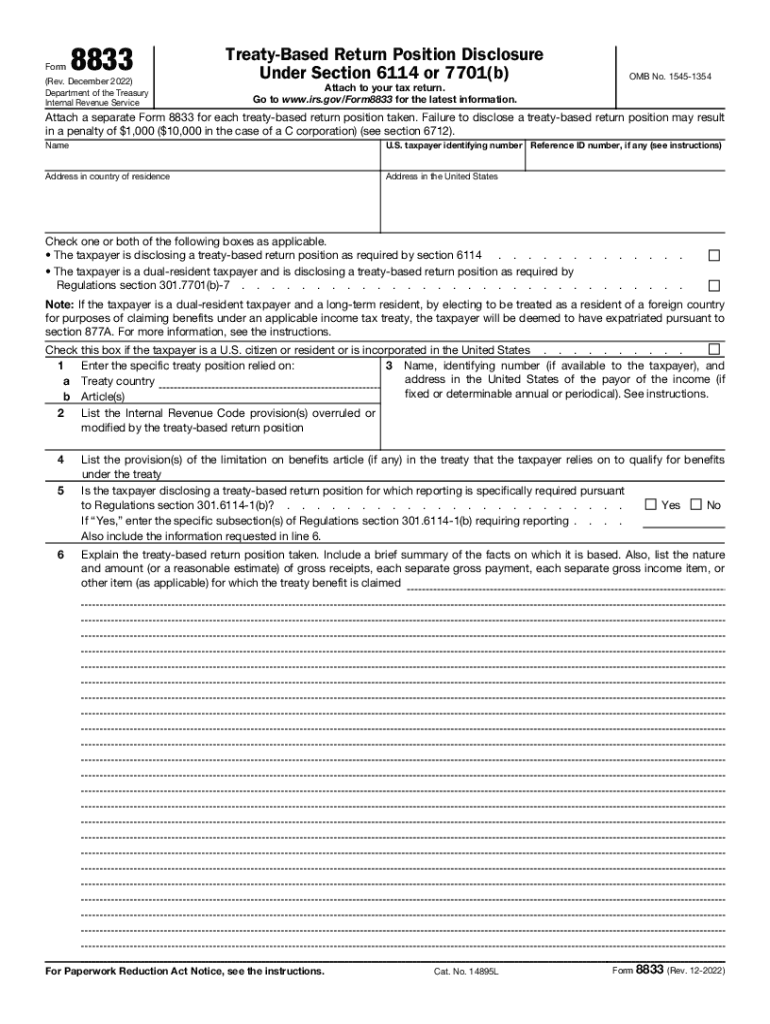

IRS 8833 2022-2024 free printable template

Get, Create, Make and Sign

Editing 8833 online

IRS 8833 Form Versions

How to fill out 8833 2022-2024 form

How to fill out tin irs:

Who needs tin irs:

Video instructions and help with filling out and completing 8833

Instructions and Help about 8833 form

Form 8833 is used to disclose when taxpayer is claiming that a tax treaty overrides some US tax rule claiming treated benefits for some purposes does not require form 8833 to be filed for example claiming that an income tax treaty modifies the taxation of certain pensions or Social Security does not need to be disclosed on Form 8833claiming treated benefits for other purposes however specifically must be disclosed on Form 8833 for example claiming that a treatynon-discrimination provision overrides some u.s. tax rule specifically must be disclosed on Form 8833 the top of the form indicates that a separate form 8833must be filed for each treaty based return position taken also there is penalty of $1,000 for failing to file the form when required to do so the penalty is $10,000 in the case of ac-corporation note that if you are unsure whether you need to file a form8833 it is generally better to file the form there is no penalty for including the form when it was not needed at the top you put your name and US taxpayer identification number the reference ID number is generally only applicable to foreign corporations you put your foreign address and/or your US address the next section has two boxes for youth check the first is for positions required to be disclosed under Section six one for the second is for dual resident taxpayers who are required to file the form 8833 under the residency regulation most of the time you would check the first box and if you area dual resident taxpayer you would check the second box the note below these boxes includes unimportant reminder for dual resident taxpayers who are long-term green cardholders that is if they claim they Carnot US residents under a treaty the exit tax rules will apply and the taxpayer will be deemed to have expatriated intersection 877 CAFé such an act can have significant US tax consequences thus ITIS important to understand these rules prior to taking such a treaty position the next section has a box to check you×39’re a US citizen or resident where corporation formed in the US online one you enter the treaty country involved and the specific article in the treaty that applies online to you list the Code section that is being modified by the treaty for example a dual resident Tatar claiming not to be a US tax resident with the overriding Code Section 7701 been line three you list the name taxpayer identification number and address of thus mayor of the income in cases where the income is fixed or determinable annual or periodical often referred tons sedan if there was no u.s. mayor of the income then this section would bereave blank on line four you list the provision in the limitation on benefits article of the treaty that applies tithe taxpayer this is usually straightforward for individuals but can get complicated for foreign corporation son line five you check yes if the regulations specifically require reporting of the position and no if than×39’t if reporting is specifically required...

Fill 8833 form : Try Risk Free

People Also Ask about 8833

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 8833 2022-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.