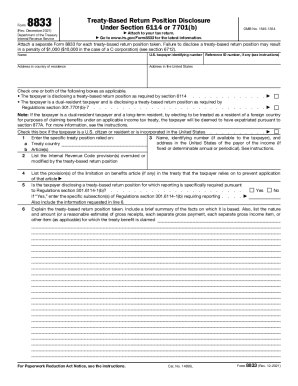

IRS 8833 2022-2026 free printable template

Instructions and Help about IRS 8833

How to edit IRS 8833

How to fill out IRS 8833

Latest updates to IRS 8833

All You Need to Know About IRS 8833

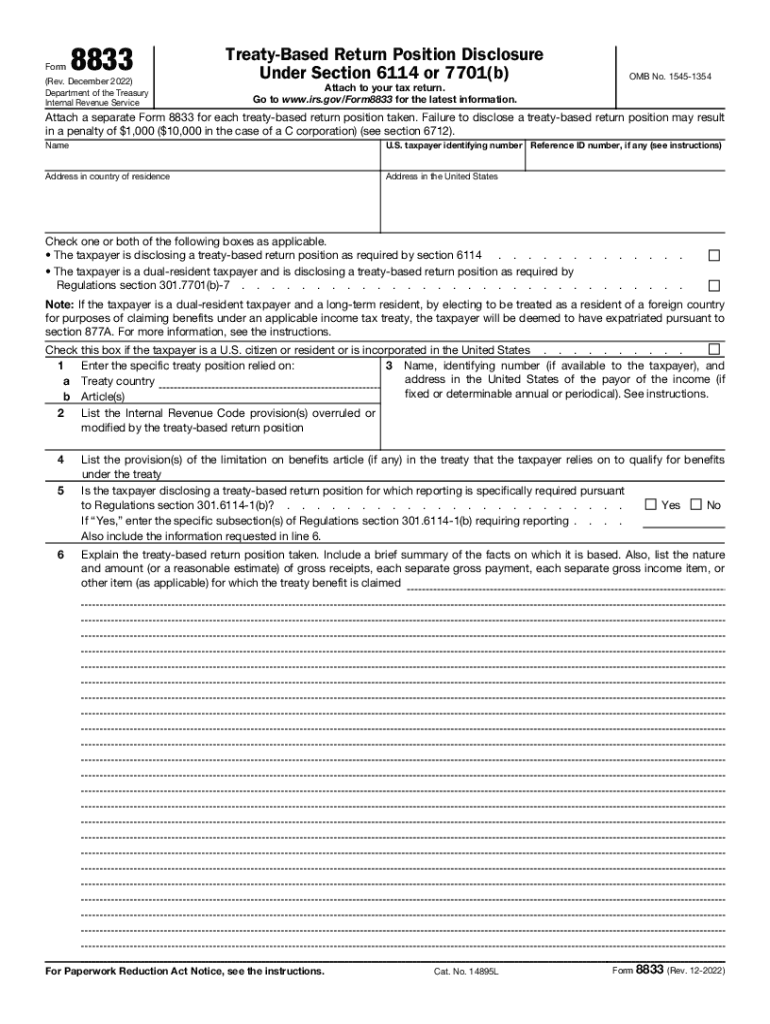

What is IRS 8833?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8833

What steps should I take if I discover an error after submitting IRS 8833?

If you find an error after filing IRS 8833, you should correct it by submitting an amended return. Use Form 8833, making sure to clearly indicate the changes made. It's essential to retain documentation explaining the correction and to track the submission's status in order to ensure it is processed correctly.

How can I check the status of my IRS 8833 submission?

To verify the status of your IRS 8833, you can use the IRS e-file status tool available on their official website. Ensure you have your details, like Social Security Number and filing status, handy. If your submission was rejected, the IRS will provide specific codes which you can use to diagnose the issue and rectify it promptly.

What should I do if I receive an IRS notice after filing Form 8833?

In case you receive a notice from the IRS after filing Form 8833, carefully read the document to understand the concern. Prepare any necessary documentation and respond promptly to avoid further issues. It's crucial to maintain a record of all communications and submissions associated with the notice.

Are there any common mistakes to avoid when submitting IRS 8833?

One common mistake when filing IRS 8833 is not properly reviewing the instructions for specific entries, leading to misreported information. Another is failing to double-check that all required signatures are included, particularly if filing on behalf of someone else. Always ensure clarity and completeness to minimize the risk of rejection.